Constitutional provision related to budget:-

Article 216 of the consolidated Parliamentary approval is required to draw money from the consolidated fund of India. The term budget is not mentioned in the constitution. The constitution refers to it as an annual financial statement

Articles 112 to 117 in the constitution deal with financial matters besides Article 114 of the constitution that no amount can be withdrawn from the consolidated fund withdraw the enhancement of a law Example:- appropriations bill

union budget 2024-25 highlights Interim budget vs full budget points of difference

How is an entry budget different from a full-fledged budget?

- Interim budget:- The Interim budget will outline the government’s anticipated receipts and expenditures until the new government is formed

- the interim budget provides financial details for the transitional period.

- The incumbent government will present an interim budget for 2024-25 in Parliament effective from 1st April 2024.

- Full budget:- A full budget encompasses all facts of government finance including earning spending allocations and policy declarations.

- Full-year budget is a strategic guide charting the nation’s economic trajectory for an entire fiscal year.

- The new government will present a complete budget in July 2024.

many people are confused about the interim budget or vote-in account so please don’t worry both are the same

Vote on account:-

- Interim budget also known as a vote on account serves as an authorisation for encouraging specific expenditures necessary until a new government assumes office.

- Entry budgets have certain limitations imposed by the Election Commission of India to ensure no undue influence on the voters.

- The government cannot propose major taxes or policy reforms in the budget as it can influence Voters.

- Typically a vote on account remains effective for a duration of two months with the possibility of extensions if necessary.

union budget 2024-25 highlights Who is responsible for repairing the budget?

The budget division of the Department of Economic Affairs in the Finance Ministry is the nodal body responsible for preparing the budget.

Former Prime Minister Manmohan Singh during his stint as finance minister delivered the longest budget speech in terms of word count 18650 words in 1991

Finance Minister Nirmala Sitaraman delivered the longest budget speech the spoke for 2.42 hours while presenting the union budget for 2020

union budget 2024-25 highlights Which Finance Minister Has done the highest budget show?

In terms of time, this time Sita Raman will be number 6th So you will see her in the top five level.

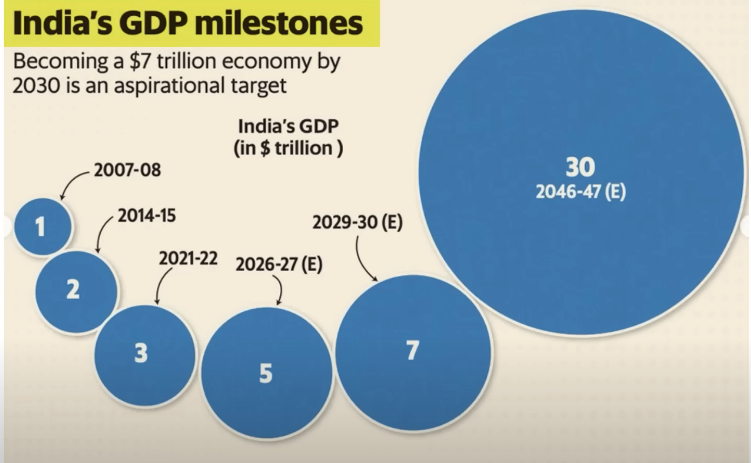

Along with this, let me tell you here that often in the budget or whenever we talk about the economy, GDP is discussed, then India has achieved some milestones like the GDP figure of 1 trillion. We achieved that in 2007, then we achieved the figure of 2 trillion dollars GDP, we have achieved that in 2014-15, then we have achieved the figure of 3 trillion dollars GDP in 2021-22, and what is being said is that it is estimated that It will be achieved in 2026-27 and you must have seen that a small economic survey came in which it was also said here that the figure of 7 trillion dollars which was just 2 days ago, will most likely be achieved by India in 2019.

union budget 2024-25 highlights How is Secrecy Ensured For The Budget?

Ensuring the confidentiality of the budget, particularly in the internet era involves meticulous efforts and remarkably there has been no leak in over 7 decades from 1951 to 1980 the budget was printed at a press on Minto Road. subsequently, a government press was established in the basement of the north block.

Prior to the budget announcement of Finance Ministry office implemented heightened security measures limiting Access for media personnel until the presentation.

Those involved in budget preparation Undergo scrutiny By the Intelligence Bureau in coordination with the Delhi Police. An intelligence team, headed by the joint secretary, Vigilantly monitors the activities of officials engaged in the process.

Finance Minister Nirmala Sitharaman began her budget speech with a reference to the union government schemes in the social sector she referred to the ‘four castes’ that the prime minister mentioned earlier in December 2023.

Interacting with Beneficiaries of Viksit Bharat Sankalp Yatra the Prime Minister said ‘’Mere Liye Desh Ki Sabse Badi Chaar Jatiyan Hain Mere Liye Sabse Badi Jaati Hai Garib Mere Liye Sabse Badi Jaati Hai Yuva Mere Liye Sabse Badi Jaati Hai Mahila Mere Liye Sabse Badi Jaati Hai Kisan (for me, there are four biggest castes in the country. for me The biggest caste is the youth, the biggest caste is women. For me, the biggest caste is farmers).’’

In Char jaatiyon Ka utthan hi Bharat ko Viksit Banega Agar Ho Chaar Ka Ho Jaega To iska matlab sab ka ho Jayega. (Only the uplift of this forecast will make India developed And if it happens to these four, it means it will happen to everyone),’’ he said.

Finance Minister Nirmala Sitharaman commenced her budget speech by acknowledging the union government schemes in the social sector and specifically referred to the ‘four castes’ mentioned by the Prime Minister in December 2023. During the Viksit Bharat Sankalp Yatra, the Prime Minister emphasized that for him, the four largest castes in the country are the youth, women, farmers, and the economically disadvantaged. He stated that the development and progress of these four castes will lead to the development and progress of the entire nation.

union budget 2024-25 highlights – NDA 1 and NDA 2

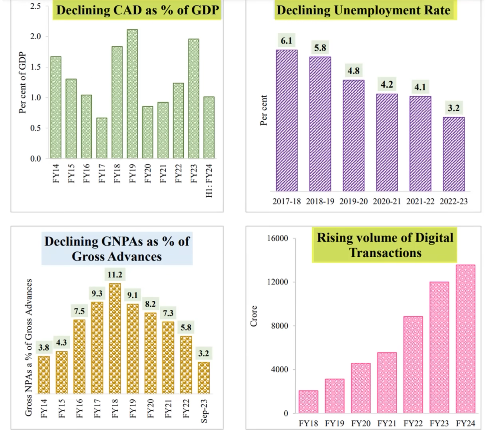

The Indian economy has witnessed a profound transformation in the last 10 years in 2014 the country was facing enormous challenges the government overcame those challenges and undertook structural reforms, and pro-people reforms were Undertaken, conditions For jobs and Entrepreneurship we are setting fruits of development started reaching people at scale country got a sense of new purpose and hope.

In the second term, the government’s strength and its Mantra and our development philosophy covered all elements of inclusivity namely social and geographical

With a whole of Nation approach the country overcame the challenges of the co-ed 19 pandemic and took a long strides towards Atma Nirbhar Bharat and Laid Foundations For Amrit Kaal.

Over the past 10 years 25 crore people come out of multi-dimensional poverty.

the government saved rupees 2.7 lakh crore by preventing leakages through direct benefit transfers worth a total of rupees 34 lakh crore through pm Jan Dhan accounts.

Under the government’s electronic National Agriculture Market (e-NaM),1,361 Mandis (APMCs)Have been integrated, benefiting crore farmers and accounting for trading volumes worth rupees 3 lakh crore, says FM.

union budget 2024-25 highlights Average real income increased by 50%

- Investments are robust, the economy is doing well people are living better and earning better.

- Average real income has increased by 50%. Inflation is moderate she says.

- The per capita income in 2013-14 was Rupees 68,572 at constant 2011 to 12 prices.

- In the advanced estimates for 2003-24, it is rupees 98374. so, that works out to 43.5%

It has been said that the GDP rate of India is above 7%. Your mini survey was released the day before yesterday and I have already made a video on it, it has also been said in it that here It is going to remain at only 7% especially after Covid, if you see, this year too, it is possible that the GDP here will remain above 70% and at the same time, it has been compared to show how India’s count is compared to the world’s. You are seeing above-average GDP here

union budget 2024-25 highlights The new definition of GDP

The finance minister says that besides Gross Domestic Product, the government is equally focused on a more comprehensive GDP-Governance and performance.

union budget 2024-25 highlights New Factor of Production

Digital public infrastructure (Aadhar UPI etc.) as a new factor of production is instrumental In the formalisation of the economy.

This combined with social and physical infrastructure is aiding progress

union budget 2024-25 highlights What Nirmala Sitharaman said the on Skill India Mission

The Skill India mission has Trend 1.4 crore youth, upskilled and Re-skilled 54 lakh youth, and established 3000 new ITIs. A large number of institutional Higher Learning, namely 7 IITs, 16 IIITs, 307 IIMs, 15 AIIMS and 390 universities have been set up’’, says Finance Minister

union budget 2024-25 highlights Nirmala Sitharaman focused on Nari Shakti and Said that

Female enrollment in higher education is up by 28% in 10 years in steam courses girls and women make up 43% of enrollment one of the highest in the world. all these steps are reflected in the increasing participation of women in the workforce making triple Talaq illegal reservation of 1/3 seats for women in Parliament and state assemblies over 70% hosses under pm Aawas Yojana to women have increased their dignity Sitharaman highlights.

union budget 2024-25 highlights Health announcement

Encourage cervical cancer vaccination for girls 19 to 14 years

Saksham Anganwadi and portion 2.0 are to be expedited for improved nutrition delivery, early childhood care and development.

U-WIN platform for immunisation efforts of mission Indradhanush to be rolled out

Health cover under the Aayushman Bharat scheme is to be extended to all Asha Anganbadi workers and helper

union budget 2024-25 highlights The boost innovation step by the government

A Corpus of 1,00,000 crores for long-term interest-free loans to boost innovation

‘’This will encourage the private sector to scale up Research and innovation in Sunrise sectors,’’ finance minister Nirmala Sitharaman said. there will be an impetus for deep tech startups working in the defence sector.

union budget 2024-25 highlights Interest-free loans to States

Many growth and development-enabling reforms are needed in the state to realise the vision of Viksit Bharat says Sitharaman

‘’Many growth and development enabling reforms are needed in the state for realising the vision of Viksit Bharat. A provision of rupees 75000 crores as 50-year interest-free loans is proposed this year to support those milestone linked reforms by the state governments,’’ the finance minister announces.

union budget 2024-25 highlights Subsidised sugar

Cabinet approves subsidy of rupees 18.50 per kg a month of sugar to beneficiaries of Antyodaya Anna Yojana (AAY) till 31st March 2026.

union budget 2024-25 highlights Mudra loans

FM Nirmala Sitharaman says 43 crore loans aggregating to rupees 22.5 lakh crore given under pm Mudra Yojana

presenting her pre-election budget which is technically a vote on account and his popularity and entering the budget the FM said that direct benefit transfer of rupees 34 lakh crore through the JanDhan account have resulted in savings of 2.7 lakh crore Sitharaman also said that 30 crore Mudra Yojana loans have been given to women in the last 10 year.

union budget 2024-25 highlights Three new corridors for the Railways

Finance Minister Nirmala Sitharaman announced three new corridors for the Railways Energy mineral and cement corridor, port connectivity corridor and high traffic density corridor. Vande Bharat movies Additionally the Finance Minister also announced that 40,000 bogies would be converted to Vande Bharat standard to improve safety and convenience for passengers The government will be launched in future time these things.

union budget 2024-25 highlights Infrastructure and investment

implementation of three major Railway corridor programs under pm Gati Shakti to improve logistics efficiency and reduce cost promotion of foreign investment via bilateral investment treaties to be negotiated

Expansion of existing airports and comprehensive development of new airports under the Udan scheme. Expansion of existing airports and comprehensive development of new airports under the Udan scheme Promotion of urban transformation via Metro rail and Namo Bharat train join Delhi to Merat

union budget 2024-25 highlights Sustainable Development

commitment to meet net zero by 2070

- Viability gap funding for wind energy

- Setting up of call gasification and liquefaction capacity

- Face mandatory blending of CNG, PNG and compressed biogas

- Financial assistant for procurement of biomass aggregation machinery

- Rooftop solarization-1 Karur household will be enabled to obtain up to 300 units of free electricity per month

- adaptation of e-buses for public transport network

- Strengthening the e-vehicle ecosystem by supporting manufacturers by charging

- A new scheme of bio-manufacturing and bio-foundry to be launched to support environment-friendly alternatives

union budget 2024-25 highlights Percentage increase in Non-Fossil fuel installed electricity capacity

- More than 10 crore LPG connections were released under the PMUY scheme

- 36.9 crore LED bulbs 72.2 Lakh LED tube lights and 23.6 lakh energy-efficient fans distributed under the UJALA scheme

- 1.3 LED streetlights installed under the SNLP scheme

What are the key points of budget 2024?

Raise capital expenditure by 11.1% to rupees 11.11 lakh crore

How many budgets are presented in India?

73 annual budgets 14 interim budgets and 4 special budgets and four special budgets, or Mini-budget.

What are the 3 types of budgets?

A surplus budget a balanced budget and a deficit budget.

What are the 7 types of budgeting?

Strategic plan budget, cash budget, master budget, labour budget, capital budget, financial budget, operating budget.

What is new in the 2024 budget?

Government to raise subsidy for rooftop solar installation to 60%

Will the tax slab change in 2024?

No changes to the Income Tax slab for 2024-25